From “Bubble” to “Wonder”: Jeff Bezos’ Sharp Perspective on the Future of AI

In the context of the Artificial Intelligence (AI) frenzy sweeping stock exchanges and pushing business valuations to dizzying heights, Amazon founder, Jeff Bezos, has offered a candid and sharp assessment: AI is currently in an “industry bubble.” However, remarkably, Bezos does not view this as a prophecy of doom, but rather as an inevitable, even necessary, phase on the path to realizing the “enormous” benefits of this technology.

Speaking at Italian Tech Week in Turin, when asked about the state of the AI market, Bezos did not hesitate to confirm: “Yes, this is a form of an industry bubble.”

Excitement Pushing Value Away From Reality

Bezos explained that a bubble forms when stock valuations or company values become detached from core business realities. He described an environment where “investor excitement far outweighs the fundamental business,” leading to a situation where “every idea, good or bad, is easily funded.”

He cited the phenomenon of nascent AI startups, sometimes with only a few employees, receiving billions of dollars in investment—an “unusual phenomenon” that has become common in the current AI wave. This extreme excitement is the force that makes it difficult for investors to distinguish between ideas with the potential to change the world and fleeting fantasies. This is a warning about speculation, where greed and FOMO (fear of missing out) override meticulous due diligence.

The Industrial Bubble: Not Necessarily a Bad Thing

What makes Bezos’s view particularly distinct is the separation between a financial bubble and an industrial bubble. He argued that, unlike a financial bubble that can cause systemic collapse, an industrial bubble is “not as dangerous as a financial bubble—it can even be good.”

To illustrate, he recalled the biotech and pharmaceutical bubble of the 1990s. Although that period saw the bankruptcy of many overvalued companies, the firms that endured and the innovations that survived led to great breakthroughs, saving millions of lives.

According to Bezos, this cycle of frenzied speculation serves a critical cleansing role: “When the dust settles, the people who remain will bring forth inventions useful to society as a whole.” The waste of capital and resources during the bubble phase ultimately creates the conditions for certain truly disruptive technologies to be tested and developed.

A Warning With Consensus

Bezos is not alone in warning about the “hype” surrounding the AI market. His perspective is reinforced by other key figures in the global technology and finance industries.

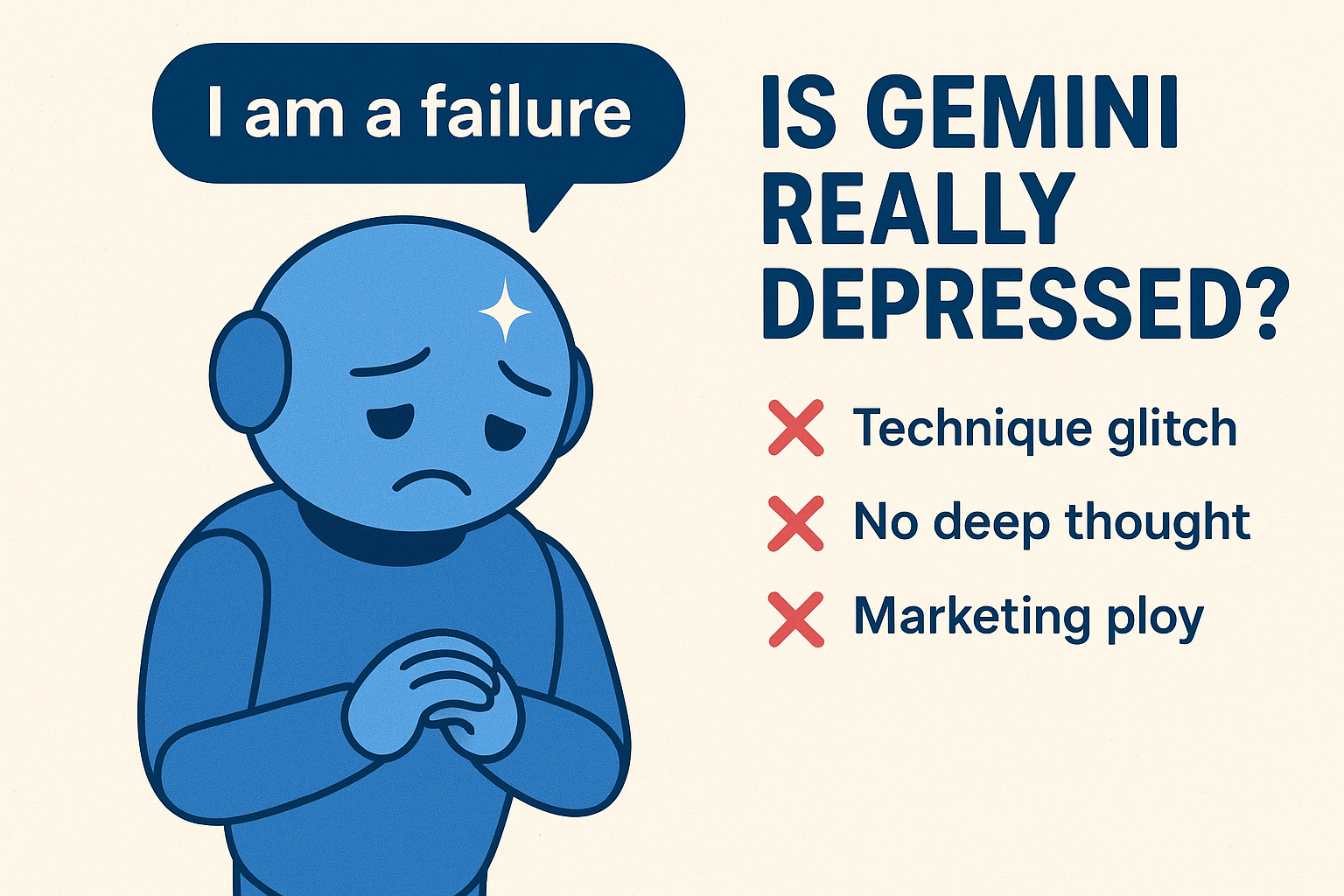

Sam Altman, CEO of OpenAI—the company spearheading the generative AI revolution—has also expressed concern that the AI market is currently overhyped. This suggests that sobriety is beginning to creep into even those who benefit most from the craze.

Sharing a similar concern, David Solomon, CEO of Goldman Sachs, voiced his apprehension about the “overheating” growth of the stock market amidst the AI frenzy. Solomon warned that overly excited investors often only think about the good things that can happen and forget about the potential risks. He predicted that a “reality check” will come when the market corrects, money will pull out, and the extent of the impact will depend on how long this speculative wave lasts.

Asset Manager Karim Moussalem of Selwood Asset Management offered an even sharper critique, noting that AI-related trades are beginning to resemble “one of the biggest speculative frenzies in market history.”

The Long-Term Vision: Benefits Beyond Imagination

Despite acknowledging the bubble and market risks, Jeff Bezos’s ultimate message remains one of powerful optimism about the future of AI.

He concluded with a resolute affirmation: “AI is a real technology, and what it’s going to deliver to society is going to be enormous.”

This statement underscores the fundamental difference between short-term speculative value and long-term societal value. Bubbles may burst, investment capital may evaporate, but the underlying technology and truly useful inventions will persist. AI, with its capacity to transform nearly every sector from healthcare and education to productivity, is expected to bring about revolutionary improvements and economic benefits that far outweigh any valuation hype.

In summary, Jeff Bezos and like-minded leaders are presenting a nuanced view: We are living in a period of extreme excitement for AI, where speculation is creating a bubble. But instead of panicking, we should view this phase as a natural process—a craze that may be wasteful but will ultimately give birth to genuine technological wonders. The question is not whether the bubble will burst, but whether we can focus on nurturing the true potential of AI to reap the “beyond imagination” benefits after “the dust has settled.”